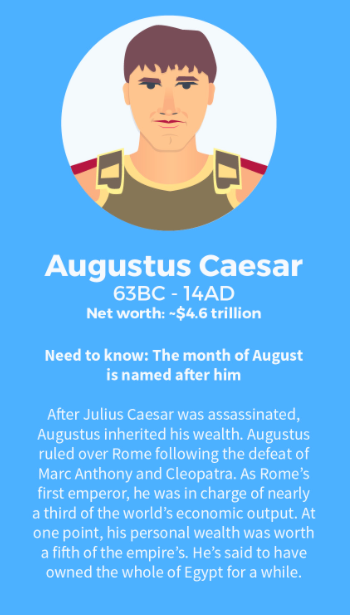

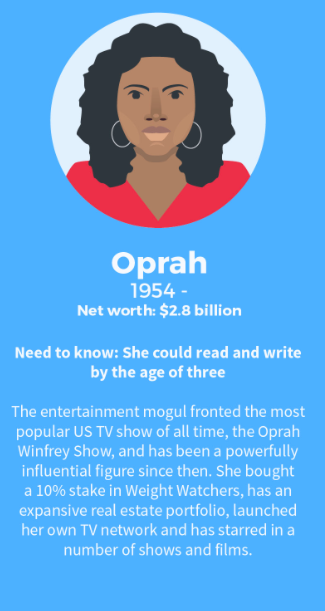

Moneyfarm’s infographic on the wealthiest people in history inspired us to think about what it takes to build wealth as many great icons have earned their profits in several different ways.

Luckily, there are several ways to increase your savings and build wealth like the icons above! Investing is just one of these ways.

If you’re new to the world of investing, simply continue reading to discover a few helpful tips which will make entering the world of investing as simple as possible.

Investing 101:

- If you’re looking to invest money for your retirement, consider investing in IRA stocks

What is the difference between purchasing stocks which are kept in an IRA account and purchasing stocks without an IRA account? If you purchase stocks specifically for your IRA account, you won’t have to pay any taxes on your purchases, which means that you’ll be able to purchase more stocks for your money. However, just keep in mind that you will have to pay tax on the passive income which your stocks have made you when you choose to withdraw your stocks, once you’ve reached retirement age.

- Try to purchase a mix of regular stocks as well as stocks in index funds

Index funds are managed funds which are comprised of stocks from a wide variety of companies and are a great option if you’re looking for medium risk stocks. As if one or two of the companies which feature in your chosen index fund experience a drop in share price, your stocks may not decrease in price. As there is a high chance that some of the other companies which are featured in your chosen index fund, will be making a strong profit.

However, it’s still worth purchasing regular stocks in companies which you believe will grow from strength to strength either in the long term or in the near future as you’ll usually make a far bigger profit from selling regular stocks over stocks in index funds. As the more risk which you take as an investor, the higher the profits are, which you’ll be able to make.

- Decide whether you’re more interested in making short term or long term investmentsAs an investor, you’ll have two options. You may be more comfortable purchasing stocks at a low price, which you’ll be able to sell a few weeks or a few months later for a reasonable profit. If you feel that you can predict when a company’s shares are about to skyrocket. Or you can choose to purchase stocks which you plan to hold on to for the foreseeable future and plan to sell for a huge profit in a decade or so.

Alternatively, you may wish to purchase a mix of short term and long term investments in order to ensure that your investment portfolio features a mix of shares. In order to decrease your investment portfolio’s level of risk.

- Don’t invest in a company, just because your friends have invested in itMake sure to complete your own research before investing your hard earned money in a company, whose stocks have been recommended to you by a friend.

If you follow the foolproof investing tips which have been outlined above, you should find it easy to make your first few investments. Which may end up making you thousands of dollars in profits!